Understanding ServiceNow Pricing – Modules, SKUs, and Hidden Costs

ServiceNow pricing is famously opaque. Unlike many SaaS products, it doesn’t have publicly posted prices or straightforward tiers. Every deal is custom, and ServiceNow pricing can vary wildly from one customer to the next. This ambiguity is by design – it gives ServiceNow flexibility to maximize each contract. But it leaves buyers negotiating in the dark.

In this guide, we’ll pull back the curtain on ServiceNow module pricing and SKUs.

You’ll learn how licenses are structured (by module, user, or asset), what “editions” like Standard vs. Pro include, and where the hidden costs lurk in typical contracts. Armed with this insider knowledge, you can budget smarter and negotiate with confidence.

Why ServiceNow Pricing Lacks Transparency

ServiceNow never publishes a price list because no two contracts are the same. The company uses high list prices as an inflated anchor, then offers steep discounts in negotiation. In fact, initial quotes often assume list price, which savvy customers know is just a starting point. Discounts of 30–50% off the list are common once you push back.

ServiceNow’s sales strategy relies on this opacity. By tailoring prices per client (based on factors like company size, modules, and perceived payment capacity), they keep maximum leverage. If they posted standard rates, big enterprises would quickly demand the same deals. Instead, you get a custom quote and likely a bit of sticker shock.

Pro Tip: Assume your first quote is a starting point, not a benchmark. The initial number is often intentionally high. Treat it as an opening bid – you’re expected to counter.

Scenario: A large enterprise received an initial ServiceNow quote of $2.5 million for a bundle of modules. Rather than accepting it, they analyzed their actual usage data and needs.

By showing which licenses were under-utilized, they negotiated the renewal down to $1.8 million – a 28% reduction. The lesson: transparency on your side (usage metrics) can beat the opacity on theirs.

Core Pricing Models by Module

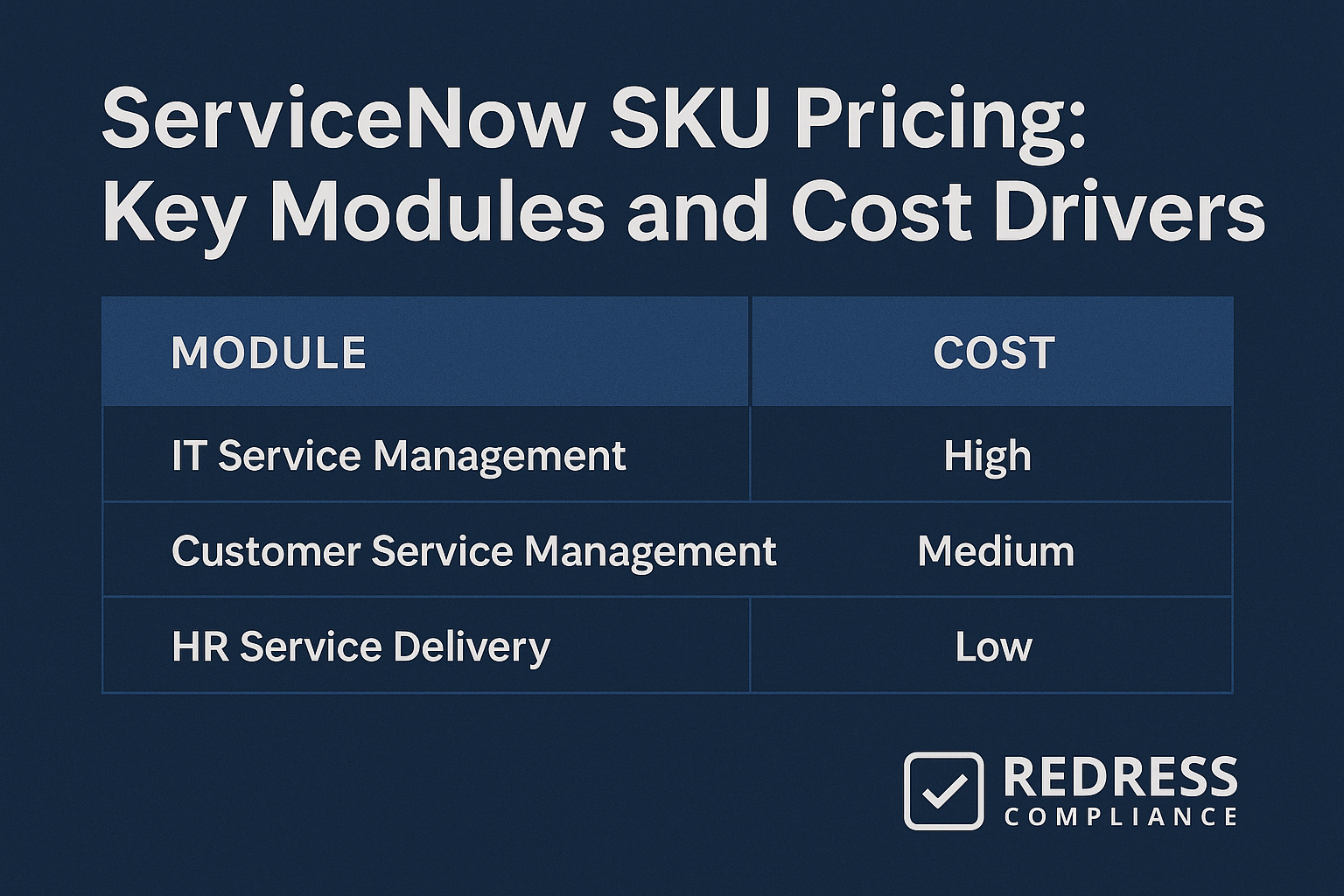

Understanding how each ServiceNow module is licensed is key to decoding your costs. ServiceNow module pricing varies by product family, each with its own metric and “unit” of charge.

Here’s a breakdown of major modules and how they’re typically priced:

- IT Service Management (ITSM): Priced per “Fulfiller” user. A fulfiller is an internal user (like an IT agent or technician) who works in ServiceNow to resolve tickets and fulfill requests. (End-users who just submit tickets are free requesters.) ITSM licensing usually comes in edition tiers (Standard, Pro, Enterprise – more on those shortly), but the core metric is the number of licensed fulfiller users.

- IT Operations Management (ITOM): Often priced per node (also called a Subscription Unit). A “node” generally means an infrastructure item being monitored or managed – servers, network devices, cloud VMs, etc. The more configuration items you bring under ITOM’s purview (Discovery, monitoring, etc.), the more nodes you need to license. Costs scale up sharply as your environment grows, so a company with 5,000 nodes will pay much less than one managing 50,000 nodes.

- Customer Service Management (CSM): Usually priced per agent user. Similar to ITSM, you pay for the support agents who use the CSM application to serve customers. However, CSM licenses tend to be pricier than ITSM because they also cover external customer-facing features (like portals or knowledge bases for your clients). In some cases, CSM pricing might factor in volume of cases or customer accounts, so clarify if there are any limits on external usage.

- HR Service Delivery (HRSD): Commonly licensed per employee (for HR service portal access) or per HR agent, depending on how it’s scoped. If you’re implementing HRSD enterprise-wide, you might be charged based on total employee count (since all employees could use the HR service portal). Alternatively, it may be licensed by HR agent users, similar to ITSM. This can vary, so determine whether the cost driver is your total headcount or a smaller set of HR staff users.

To summarize the module vs. metric structure, here’s a quick reference:

| Module | Pricing Metric | Common Cost Driver |

|---|---|---|

| ITSM | Per Fulfiller User | Number of IT agents; Edition tier (Standard/Pro/Enterprise) |

| ITOM | Per Node | Number of infrastructure elements (servers, devices, etc.) |

| CSM | Per Agent | Number of support agents; (customer volume may influence) |

| HRSD | Per Employee or Per HR Agent | Total employee count or HR staff count |

Pro Tip: If you can’t define the metric (user, node, or asset), you can’t control the spend. Always get a clear definition in the contract of what exactly counts as a “user” or “node” for each SKU. For example, which roles need a full license? What qualifies as a billable node? Without precise definitions, you might overpay due to ambiguity.

Edition Tiers – Standard vs. Pro vs. Enterprise

Most ServiceNow product lines offer tiered editions (often named Standard, Professional (Pro), and Enterprise). The higher the tier, the more features are bundled – and the higher the cost. It’s a classic upsell model: Standard covers core features, Pro adds advanced capabilities like AI and analytics, and Enterprise may include unlimited usage or extra modules.

For example, ITSM Standard is the base IT service management package. ITSM Pro typically bundles in things like Virtual Agent (chatbot), Performance Analytics, or other AI-powered features. ITSM Enterprise might further include broader platform use rights. The gap in price from Standard to Pro can be significant – often 30-50% more – and the Enterprise tier is even higher.

The big gotcha: sales reps will often pitch the Pro/Enterprise tier on the promise of future innovation. “You’ll eventually want these AI features, so upgrade now” – that sort of argument. But if you don’t end up using those advanced features, you’ve paid a premium for nothing. Higher tiers make sense only if you will realistically use the extra functionality during the term of the license.

Scenario: A global manufacturer was on ITSM Standard but was persuaded to upgrade to ITSM Pro because it included the Virtual Agent chatbot (and other AI tools). The upgrade added roughly $400,000 per year to their bill. Two years later, they realized their team never actually deployed the Virtual Agent in production – the feature that justified the Pro tier remained shelfware. They essentially burned $800K on “potential” value that never materialized.

Pro Tip: Buy for proven use, not theoretical potential. If a feature sounds good but isn’t part of your current roadmap, don’t pay for it yet. It’s better to start on a lower tier and upgrade later if needed, than to overspend now on an Enterprise package “just in case.”

Bundled Packages vs. À La Carte Licensing

ServiceNow offers bundled packages (often called suites or enterprise bundles) that combine multiple modules under one umbrella license. For example, an ITx Workflow package might bundle ITSM, ITOM, ITAM (asset management), and more for a fixed price. There’s also an “Enterprise Platform” license that promises a range of products in one contract.

Bundling benefits: You get an overall discounted rate versus buying each module à la carte. It also simplifies the contract by including one renewal date and potentially allowing some flexibility to swap licenses internally. If you truly need all components in the bundle, it can be cost-effective.

Bundling risks: You might be forced to purchase and maintain modules you don’t actually need or use. Bundles sometimes have minimum commitments that lock you into higher spending. And if one piece of the bundle isn’t delivering value, you can’t drop it without renegotiating the whole thing.

Always run the numbers both ways – what would it cost to buy only the modules you want individually versus the bundle price? Sometimes the “bundle discount” is a mirage, especially if 20% of the bundle is shelfware for you.

Scenario: A large regional bank had been on ServiceNow’s Enterprise Platform bundle, which included IT workflows, HR, CSM, and more under one big annual sum. After a few years, they realized they barely used the HR Service Delivery (HRSD) module included in the bundle.

At renewal, they decided to break out of the bundle. By licensing ITSM, ITOM, and CSM à la carte and dropping HRSD, they eliminated about 17% of their total spend. The savings were significant, and they could always add HRSD later if a real need emerged.

Pro Tip: Do the math both ways — bundling can be a trap disguised as value. Sales will tout bundle discounts, but calculate your effective cost per module. If you’re paying for extras you don’t use, an à la carte deal might save money and give you more flexibility long-term.

Hidden Costs and Add-Ons

Buying ServiceNow is not like buying an “all-inclusive” buffet. There are plenty of extras and usage-based fees that can bite you if you’re not aware. Let’s uncover some common hidden cost areas (the “gotchas”) beyond the core license fees:

- Storage Overages: Every ServiceNow instance includes a certain amount of data storage (often around 4 TB per instance in many contracts). This covers your database records and file attachments. If you exceed that allotment – for example, by accumulating lots of ticket attachments, large audit logs, etc. – you could face overage charges or be asked to purchase additional storage blocks. These fees are usually monthly and can add up quickly if your usage grows unchecked.

- Integration Hub: ServiceNow’s Integration Hub (part of the Automation Engine) enables out-of-the-box integrations and workflows with external systems via “spokes”. Basic Integration Hub capabilities might be included, but if you start using a lot of integration content (connecting ServiceNow to Slack, Azure, SAP, etc.), you may need a higher-tier Integration Hub license. These are typically priced by the number of transactions or a throughput limit. Heavy use beyond the free tier will trigger additional costs. Many customers don’t realize that an integration feature isn’t fully free until they receive a bill for exceeding a certain cap.

- Orchestration & Automation: Similar to Integration Hub, advanced workflow automation (like Orchestration activities that run scripts on external systems, or Robotic Process Automation bots) may require separate licensing. ServiceNow might sell these as part of an “Automation Engine” package or standalone orchestration add-ons. If you plan to do things like automatically resetting passwords on AD, running PowerShell on servers from ServiceNow workflows, etc., check if an Orchestration SKU is needed.

- Secondary (Non-Production) Instances: Your subscription typically includes a production instance and a limited number of non-prod instances (such as one development/test instance, maybe one QA instance). If you require additional environments – e.g., a dedicated training environment, or a second sub-production instance for a project – those may come at an extra charge. Also, if you want a failover production instance for high availability, that’s an add-on. Don’t assume unlimited instances; clarify how many are included and the cost for more.

- Premium Support: The standard ServiceNow support (usually business-hour support and online portal access) comes with your subscription. However, ServiceNow offers premium support tiers (like Premier Support or the newer ServiceNow Impact program) at additional cost. These might include a designated support team, faster response SLAs, health monitoring, or advisory services. Unless you explicitly need that, be careful that a quote doesn’t sneak it in as an optional line item. Premium support can add significant cost (often a percentage uplift on your license spend).

This is not an exhaustive list – depending on your implementation, there could be other extras (for example, Performance Analytics, if not included in your edition, or external user community licenses for CSM). The key is to anticipate these before signing the contract. Always ask, “What’s not included in this quote that we might need later?”

Pro Tip: Ask your rep, “What new costs could appear in 12 months?” to expose hidden SKUs. Encourage them to discuss topics like storage, integration transactions, extra modules, or overage fees that aren’t obvious upfront. Getting those into the open will prevent nasty surprises down the road.

Module-Specific Pricing Quirks

Each module has its own licensing wrinkles. Here are a few notable ones that often catch buyers off guard:

- ITOM and “Nodes”: What exactly counts as a “node” in IT Operations Management licensing? This is crucial because if your definition differs from ServiceNow’s, you might vastly underestimate costs. Generally, a node is any managed configuration item that the ITOM services are monitoring or discovering. That can include physical servers, VMs, network routers, switches, databases – even cloud resources like an AWS EC2 instance. Some CI types might not count (for example, printers or peripherals may be excluded in some cases), but generally, if it’s tracked and services are running against it, it’s a node. Always get a precise count of CIs that will count as nodes, and understand if they charge differently for “light” nodes vs “heavy” nodes. Misdefining a node could blow your ITOM budget if, for example, you thought each data center counted as one node, but ServiceNow counts each server as one.

- CSM External Usage: With Customer Service Management, clarify how external customer access is handled. Typically, you don’t pay for individual customers – you pay for the agents. But if you have a large customer portal or knowledge base accessed by millions of end users, ensure there aren’t any tiers or limits based on volume of cases or contacts. ServiceNow usually allows unlimited customers in CSM, but high volume might push you toward higher license bundles for performance reasons. Also, if you need a partner or consumer portal separate from core CSM, that might be another SKU (e.g., Partner Service Management).

- App Engine (Custom Apps): ServiceNow’s App Engine allows you to build custom business applications on the Now Platform. Here’s the catch: many customers start building simple apps or tables as part of ITSM or another module (which seems “free” at first), but as those apps grow or become mission-critical, ServiceNow may require an App Engine license. Often, the trigger point is when your custom app usage exceeds a certain threshold – it could be the number of custom tables, or users beyond IT using the app, etc. The App Engine license can be a hefty add-on (six figures is not uncommon). It often blindsides teams that thought their customizations were included. Always ask, “At what point do we need an App Engine SKU?” if you plan to develop custom applications beyond the delivered modules.

Scenario: A national retailer built a series of custom workflow apps on their ServiceNow instance to handle store support requests and inventory adjustments. These started as small additions, but over a year, they grew into a key part of the platform – essentially a custom application servicing hundreds of users.

Mid-year, ServiceNow informed them that their usage crossed into App Engine territory, and they would need to true-up with an App Engine license costing $250,000 annually. It wasn’t in the budget, since nobody had anticipated that hidden licensing threshold.

Pro Tip: Every cool automation feature usually hides a licensing threshold — learn where yours starts. Whether it’s how many Flows you can run before needing Integration Hub, or how many custom tables you can use before App Engine, know the limits. Design and plan around those limits to avoid accidentally triggering a massive new cost.

Sample Cost Ranges (Indicative Only)

Let’s talk numbers. While every contract is different, here are some rough benchmarks for ServiceNow pricing to give you a sense of scale. These ranges are purely illustrative – your actual quotes may differ, but it’s helpful to have a ballpark:

- ITSM (Pro tier) – roughly $600K–$900K per 1,000 fulfiller users per year. This assumes an enterprise-level discount. At list price, 1,000 ITSM Pro users could easily top $1M+ annually (list might be around $100+ per user per month). But real deals often come in well under that after negotiation. Smaller deployments (hundreds of users) will pay more per user; very large deployments (several thousand users) might negotiate to the low end of that range or better.

- Customer Service Management (CSM) – typically 20–30% higher cost per agent than equivalent ITSM licensing. In other words, if an ITSM fulfiller is $X, a CSM agent might be $1.2–$1.3 X. This premium reflects the added functionality for customer support. For example, if ITSM is ~$1000/user/year at list, CSM might be $1300/user/year. In practice, for 1000 CSM agents, you could be looking at a contract 20–30% higher than for 1000 ITSM users. Plan accordingly if you’re adding CSM on top of ITSM.

- ITOM – costs can grow rapidly beyond ~10k nodes. ITOM is often sold in tiers of node counts (for instance, up to 5k nodes, up to 10k, up to 50k, etc.). The cost per node might decrease at larger volumes, but the total cost skyrockets as you manage more infrastructure. As a rough idea, managing 5,000 nodes might cost in the mid-six figures annually for ITOM licenses. Going to 20,000+ nodes can push you into the seven-figure territory just for ITOM. Always forecast how your environment might expand in 2-3 years – that extra cluster or cloud expansion could sharply increase your licensing needs if you cross into a higher node band.

(Note: These ranges exclude things like implementation services or third-party costs – we’re just talking license fees. Also, modules like HRSD, SecOps, ITBM, etc., will each have their own pricing similar in scale to ITSM if user-based, or to ITOM if asset-based.) The main takeaway is to never use ServiceNow’s “list price” as your budgeting benchmark. Real-world pricing is usually far lower after discounts and highly variable. Use peer benchmarks and independent advice to sanity-check any quote you receive.

Pro Tip: Don’t benchmark against list prices — benchmark against peer deals. If you can, find out what similar organizations (in your industry or size) are paying for a comparable ServiceNow scope. Sales reps might hate it, but having an informed target (e.g., “companies our size typically pay around $Y per user”) gives you leverage to demand a competitive rate.

Negotiation Implications

Why go through all this pricing minutiae? Because knowledge is power when negotiating with ServiceNow. Understanding the SKUs, metrics, and hidden costs gives you levers to push for a better deal. Here are some negotiation implications of having this pricing insight:

- Eliminate fluff: By identifying each SKU in your quote, you can challenge ones that seem unnecessary. If you see a module you don’t recognize or need, ask to have it removed. Vendors sometimes slip in extra line items “for value” that you can live without. Dropping unneeded modules or reducing counts is the fastest way to cut costs.

- Cap or remove overage fees: If you know storage or transactions could spike costs, negotiate them upfront. For instance, you might negotiate a higher storage allowance instead of unpredictable overage fees, or insist on clarity that integration transactions are unlimited or have a safe buffer. Use the hidden cost areas as a checklist to get fixed terms for each (so you won’t be blindsided later).

- Demand itemized transparency: Don’t accept a lump-sum quote like “ServiceNow enterprise subscription – $X million.” Insist that the quote be broken down by module, edition, and SKU, each with a price. This line-by-line transparency lets you see what you’re paying for each piece. It also lets you apply pressure on specific items (“Why is this module priced so high relative to others?”). Remember, transparency isn’t offered – it’s demanded. ServiceNow won’t volunteer granular pricing; you have to ask.

- Leverage usage data: As mentioned earlier, bring your own data to the table. Know how many licenses are actually being used, which features were deployed, and which weren’t. If you can point out that 15% of your licenses went unused, you can argue to remove them (or get them for free as a credit). If a module wasn’t rolled out, consider swapping it for something else more useful or dropping it.

Scenario: A utility company was facing a steep renewal increase. Before negotiations, their IT asset manager did a full audit of their ServiceNow usage and SKUs. They discovered that over the past year, about 12% of their purchased licenses and modules were “shelfware” – paid for but hardly used.

Armed with this, they approached ServiceNow and firmly requested the removal of those unused SKUs from the renewal. After some arm-wrestling, ServiceNow conceded, removing roughly $1.1 million worth of excess licensing from the contract. Without that SKU-level visibility, the company might have simply renewed and overpaid for another term.

Pro Tip: Transparency from the vendor has to be fought for line by line. Don’t be shy about asking tough questions on each cost component. You might phrase it as wanting to “understand the value of each line item” – perfectly reasonable when you’re spending millions. The more granular the discussion, the more opportunities you have to find savings or get concessions.

Related articles

- ServiceNow Bundle vs Standalone: Choosing Cost-Effective Packages

- ServiceNow Volume Discount: Understanding Tiered Pricing and Enterprise Savings

- ServiceNow SKU Pricing: Key Modules and Cost Drivers

- ServiceNow Pricing Gotchas: How to Avoid Hidden Fees

- ServiceNow Module Pricing Negotiation: Using SKU Insights for Better Deals

5 Insightful Next Steps for Buyers

If you’re gearing up for a ServiceNow renewal or a new purchase, here are five actionable steps to take now:

- Request a Full SKU Inventory: Ask your ServiceNow account rep for a complete list of the SKUs and modules in your environment before any new quote. This means every module, edition, user type, etc., that you’re currently licensed for (or being quoted for). It’s hard to negotiate what you can’t see – get all the cards on the table.

- Map SKUs to Actual Usage: Take that SKU inventory and do an internal usage audit. For each module or license type, determine how it’s being used and by whom. Identify obvious over-provisioning (e.g., 500 HRSD licenses assigned but only 300 HR employees in the company, or ITOM nodes far beyond your CI count). This mapping will highlight where you’re overpaying or where you might actually need more of something.

- Benchmark Discounts and Deals: Don’t go in blind on pricing. Reach out to peers in other companies, consult independent advisors, or use user community data (where available) to benchmark. Know that, for instance, “ServiceNow ITSM pricing for an organization of our size usually sees about 40% off list” – whatever the figure may be. Also benchmark module adoption – know which modules are commonly discounted more heavily. ServiceNow’s willingness to discount can vary by module (they might cut a better deal on newer products to drive adoption, for example).

- Run a 2-Year Cost Projection: Budgeting isn’t just about the immediate quote. Model out your total cost of ownership over the next 12–24 months. Include likely growth in users or nodes, potential add-ons (integration needs, more storage), etc. This projection helps you foresee costs that sales might not mention now. For example, if you know you’re opening a new office and adding 200 employees next year, bake in what that does to your ITSM and HRSD license needs. If you plan to integrate ServiceNow with five new systems, consider the Integration Hub transactions that will be generated. Laying this out now means you can negotiate for those future needs upfront (or at least avoid being shocked later).

- Negotiate Clarity and Clauses: Finally, when you do get to negotiation, push for clear contract terms on all these points. Ensure the quote and contract specify things like the metric definitions (what’s a user, what’s a node), the rights you have (e.g., ability to reduce or swap licenses at renewal), and any caps on price increases or overage fees. If a particular add-on is supposed to be “included,” have it in writing. Basically, no hidden gotchas left unaddressed. A good contract will spell out exactly what you’re paying for and what happens if you need more.

By demystifying ServiceNow’s pricing structure and asking the right questions, you transform a potentially one-sided negotiation into a balanced discussion. Remember, ServiceNow’s pricing transparency won’t be given freely – but with the insights from this guide, you can demand it and make sure you’re getting real value for every dollar. Good luck, and negotiate hard!

Read about our ServiceNow Negotiation Service.